In this article we will discuss about the feasibility analysis or process of project report preparation for MSMEs Micro Small and Medium Enterprises in Entrepreneurship Development. nd lending institutions. There are five types of feasibility study—separate areas that a feasibility study examines, described below. Technical feasibility, Managerial feasibility, Marketing feasibility, Legal feasibility, Operational feasibility, Financial Feasibility, Economic Feasibility, scheduling feasibility.

Project Report Preparation

Your company seeking financial assistance for implementation of its business idea is required to prepare a Project Report covering certain important aspects of the project report preparation, as detailed below:

- Promoters background/experience

- Product with capacity to be built up and processes involved

- Project location

- Cost of the Project and Means of financing Its

- Availability of utilities

- Technical arrangements

- Market Prospects and Selling arrangements

- Environmental aspects

- Profitability projections and Cash flows for the entire repayment period of financial assistance

Since the appraisal of the Project involves evaluation of the Project in the following areas, your company/you would be required to submit certain documents/information in the matter. project report preparation flow

Steps and Process of Project Report Preparation for MSMEs – Entrepreneurship Development

Following are the various feasibility analysis and process of project report preparation for MSMEs – Micro Small and Medium Enterprises – Entrepreneurship Development. Management Evaluation, Technical feasibility, Commercial / Marketing Viability, Financial feasibility, economic feasibility.

The growth and recognition of project management training have changed significantly over the past few years, and these changes are expected to continue and expand. And with the rise of project management comes the need for a feasibility study.

It can be thrilling to start a complex, large-scale project with a significant impact on your company. You are creating real change. Failure can be scary. This article will help you get started if you have never done a feasibility study on project management.

Getting certified as a project management professional is simple with Simplilearn’s PMP Certification. Take advantage of this opportunity by enrolling now.

What is a Feasibility Study?

A feasibility study is a comprehensive evaluation of a proposed project that evaluates all factors critical to its success in order to assess its likelihood of success. Business success can be defined primarily in terms of ROI, which is the amount of profits that will be generated by the project report preparation.

A feasibility study evaluates a project’s or system’s practicality. As part of a feasibility study, the objective and rational analysis of a potential business or venture is conducted to determine its strengths and weaknesses, potential opportunities and threats, resources required to carry out, and ultimate success prospects. Two criteria should be considered when judging feasibility: the required cost and expected value.In a feasibility study, a proposed plan or project is evaluated for its practicality. As part of a feasibility study, a project or venture is evaluated for its viability in order to determine whether it will be successful.

As the name implies, a feasibility analysis is used to determine the viability of an idea, such as ensuring a project is legally and technically feasible as well as economically justifiable. It tells us whether a project is worth the investment—in some cases, a project may not be doable. There can be many reasons for this, including requiring too many resources, which not only prevents those resources from performing other tasks but also may cost more than an organization would earn back by taking on a project that isn’t profitable.

A well-designed study should offer a historical background of the business or project, such as a description of the product or service, accounting statements, details of operations and management, marketing research and policies, financial data, legal requirements, and tax obligations. Generally, such studies precede technical development and project implementation.

Understanding A Feasibility Study

Project management is the process of planning, organizing, and managing resources to bring about the successful completion of specific project goals and objectives. A feasibility study is a preliminary exploration of a proposed project or undertaking to determine its merits and viability. A feasibility study aims to provide an independent assessment that examines all aspects of a proposed project, including technical, economic, financial, legal, and environmental considerations. This information then helps decision-makers determine whether or not to proceed with the project.

The feasibility study results can also be used to create a realistic project plan and budget. Without a feasibility study, it cannot be easy to know whether or not a proposed project is worth pursuing. nd lending institutions. There are five types of feasibility study—separate areas that a feasibility study examines, described below. Technical feasibility, Managerial feasibility, Marketing feasibility, Legal feasibility, Operational feasibility, Financial Feasibility, Economic Feasibility, scheduling feasibility.

Managerial Feasibility Analysis

Managerial Feasibility Analysis

- Memorandum and Articles of Association : Object, authorised and paid-up share capital,promoter’s contribution, borrowing powers, list of directors on the Board, terms of appointment of directors

- Your company as the Promoter : Corporate plan of the Company, projects promoted/implemented/under implementation, Bankers’ report on dealings and repayment of past loan assistance, details of group companies, operations, balance sheet and profit & loss account of the promoter company

- New Promoters : Educational background, any industrial experience, family background, sources of income, details of personal properties, banker’s reference, income tax/ wealth tax returns

- Management and Organisation set up : Broad composition of the Board, details of full time directors and their responsibilities, details of Chief executive and functional executives including qualification, experience, organisation set-up for existing company and during project implementation for new company.

Technical Feasibility Analysis

- Technology and manufacturing process : Proven/new technology, basis of selection of technology, competing technologies, performance data of plants based on the technology, details of licensor of technology, process flow chart and description

- Location of the Project : Locational advantage, availability of raw material and other utilities, infrastructure facilities, availability of labour, environmental aspects

- Plant and Machinery : List of machinery & equipment, details of suppliers, competitive quotations, technical & commercial evaluation of major equipment

- Raw material, Utilities and Manpower : Details of raw materials and suppliers, electricity and water supply, basis of manpower estimates, details of manpower eg. managerial, supervisory, skilled/unskilled, training needs

- Contracts : Agreement with contractors detailing on know-how, engineering, procurement, construction, financial soundness and experience of contractors

- Project monitoring and implementation : Mode of implementation, details of monitoring team, detailed schedule of implementation.

Environmental Aspects: Air, Water and Soil pollution; list of pollutants / Hazardous substances, their safety, handling and disposal arrangements, compliance with national and International standards; Clearances and No objection certificates required and obtained; etc.

Marketing Feasibility

- Existing and potential market demand and supply for the proposed product in respect of volume and pattern

- Share of the proposed product of the company in the total market through marketing strategy

- Selling price of the product and export potential, if any.

- Buy-back arrangements, if any.

Financial Appraisal

- Cost of the Project : This includes the cost of land & site development, building, plant & machinery, technical know-how & engineering fees, miscellaneous fixed assets, preliminary & preoperative expenses, contingencies, margin money for working capital. Your company is expected to submit realistic estimates and reasonableness of the cost of the project will be examined with reference to various factors such as implementation period, inflation, various agreements, quotations etc.

- Means of Financing : Means of financing shall have to conform to proper mix of share capital and debt. This includes share capital, unsecured loans from Promoters/associates, internal accruals, term loans, Government subsidy/grant. Reasonableness of Promoters’ contribution in the form of equity and interest-free unsecured loans, if any, is ascertained in view of commitment to the Project.

- Profitability Projections : Past records of financial performance of Your company will be examined. Your company needs to submit profitability estimates, cash flow and projected balance sheet for the project and for the Company as a whole. Based on the projections, various financial ratios such as Debt -Equity ratio, Current ratio, Fixed asset coverage ratio, Gross profit, Operating profit, Net profit ratios, Internal rate of return(over the economic life of the project), Debt Service Coverage ratio, Earning per share, Dividend payable etc. would be worked out to ascertain financial soundness of your Project.

Economic Viability

- Your company will have to take real value of input as against the value accounted in financial analysis for the purpose of economic evaluation of the project.

- Your company should carry out social cost benefit analysis as a measure of the costs and benefits of the project to Society and the Economy.

- Economic analysis is therefore aimed at inherent strength of the Project to withstand international competition on its own.

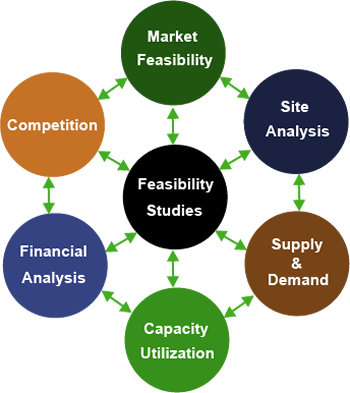

Types of Feasibility Study

A feasibility analysis evaluates the project’s potential for success; therefore, perceived objectivity is an essential factor in the credibility of the study for potential investors and lending institutions. There are five types of feasibility study—separate areas that a feasibility study examines, described below. Technical feasibility, Managerial feasibility, Marketing feasibility, Legal feasibility, Operational feasibility, Financial Feasibility, Economic Feasibility, scheduling feasibility.

1. Technical Feasibility Analysis

This assessment focuses on the technical resources available to the organization. It helps organizations determine whether the technical resources meet capacity and whether the technical team is capable of converting the ideas into working systems. Technical feasibility also involves the evaluation of the hardware, software, and other technical requirements of the proposed system. As an exaggerated example, an organization wouldn’t want to try to put Star Trek’s transporters in their building—currently, this project is not technically feasible.

2. Economic Feasibility

This assessment typically involves a cost/ benefits analysis of the project, helping organizations determine the viability, cost, and benefits associated with a project before financial resources are allocated. It also serves as an independent project assessment and enhances project credibility—helping decision-makers determine the positive economic benefits to the organization that the proposed project will provide.

3. Legal Feasibility

This assessment investigates whether any aspect of the proposed project conflicts with legal requirements like zoning laws, data protection acts or social media laws. Let’s say an organization wants to construct a new office building in a specific location. A feasibility study might reveal the organization’s ideal location isn’t zoned for that type of business. That organization has just saved considerable time and effort by learning that their project was not feasible right from the beginning.

4. Operational Feasibility

This assessment involves undertaking a study to analyze and determine whether—and how well—the organization’s needs can be met by completing the project. Operational feasibility studies also examine how a project plan satisfies the requirements identified in the requirements analysis phase of system development.

5. Scheduling Feasibility

This assessment is the most important for project success; after all, a project will fail if not completed on time. In scheduling feasibility, an organization estimates how much time the project will take to complete.

When these areas have all been examined, the feasibility analysis helps identify any constraints the proposed project may face, including:

- Internal Project Constraints: Technical, Technology, Budget, Resource, etc.

- Internal Corporate Constraints: Financial, Marketing, Export, etc.

- External Constraints: Logistics, Environment, Laws, and Regulations, etc.

Discover more from Easy Notes 4U Academy

Subscribe to get the latest posts sent to your email.